Financial Results 2018

The organisation’s statement of surplus or deficit and other comprehensive income for the year ended 30 June 2018 shows a surplus of $2,598,991 (2017: $1,986,028).

Total revenue for the current financial year is $127,758,582 (2017: $117,470,692). The main increases in revenue this year are due to the continued growth of Health Solutions whose sales reached $97 million (a 12% increase on the previous year).

The statement of financial position at 30 June 2018 shows the organisation remains financially strong with total members’ equity of $23,693,698 (2017: $20,986,135).

The following charts provide a snapshot of Independence Australia’s non-Health Solutions related activities over the last 12 months. There are still challenges in the provision of quality services in a changing environment with the continued growth of customer choice arising from the rollout of the NDIS being at the forefront of our activities. The transition from block funded services to customer choice has had an impact on systems and cash flow and created additional reconciliation processes to ensure that data is captured correctly. We strive to provide effective and efficient services, whilst remaining responsive to community needs with our limited resources.

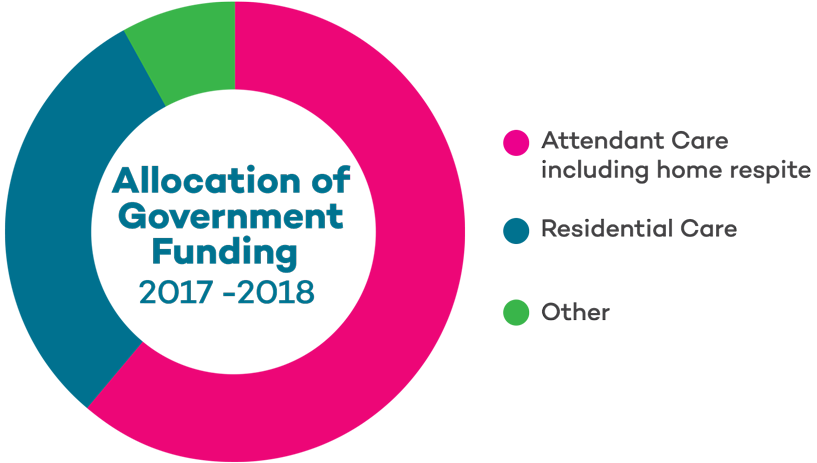

Allocation of Funding

Government grants were received to support clients both in their own home, in residential settings and in the community. The vast majority was attendant care (including respite services) provided in people’s own homes and in our residential settings. Our other services, whilst lower in gross terms, still represent a significant contribution to the community.

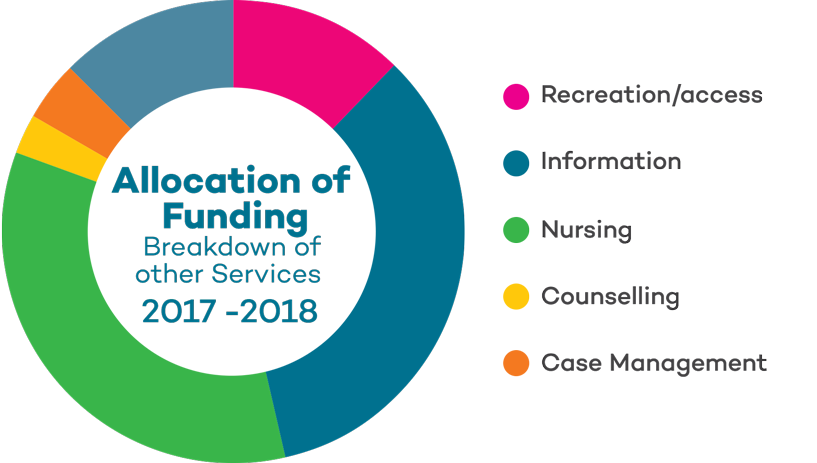

Allocation of Funding (other)

Other services are those used on a daily basis to provide counselling, nursing, recreation, case management and information services. These will diminish over time as these services transition to the NDIS model.

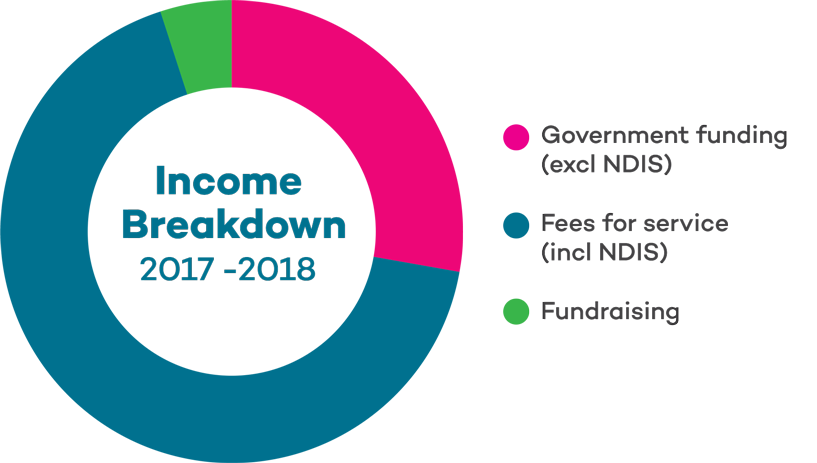

Income Streams

The analysis of income generated by Independence Australia (excluding Health Solutions) showed that Government grants accounted for less than 30% of the income, reflecting the impact that the transition to the NDIS is having on the sector. Fees for service including services to the NDIS and insurers such as TAC and WorkSafe continues to grow, whilst the remainder is from our fundraising activities.

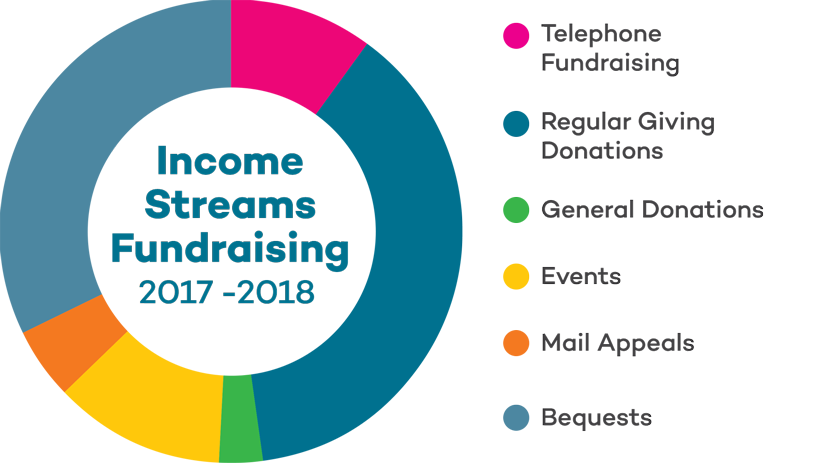

Income Streams - Fundraising

We are very pleased with the percentage of donations to our Regular Giving Program, as this is the most cost-effective giving option for the future. Telephone fundraising continued to be the backbone for all of our fundraising by recruiting our new donors and setting up support through our other fundraising strategies. A very high percentage of donors for all other categories can be traced back to their beginnings through telephone fundraising.